The Illinois Rental Lease Agreements are property management contracts used for establishing formal landlord-tenant relationships. Each agreement reflects applicable federal and state rental laws, ensuring the agreements protect landlords and property owners from undue liability. Once signed by both the landlord and tenant(s), the contract goes into effect until the scheduled termination of the lease (except for month-to-month leases and roommate agreements).

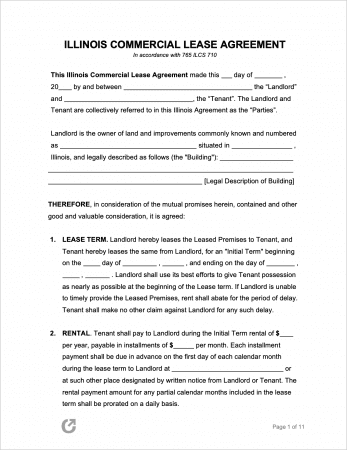

Commercial Lease Agreement – A comprehensive form used for leasing property to business-owning tenants for a period of one (1) to five (5) years.

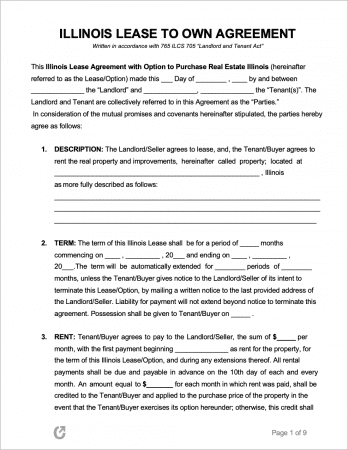

Lease to Own Agreement – Commonly used by those in the process of selling their home to make rental income before selling the property. Gives tenants the option (not the requirement) to purchase the leased home.

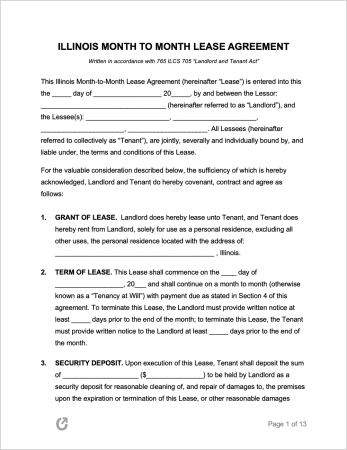

Month-to-Month Lease Agreement – Contains similar conditions and sections to a standard lease, with the exception that it contains no end-date (either party can terminate the contract with one (1) month of notice).

Roommate Agreement – Created between roommates, allows for clarification over cleaning duties, guests, noise, possessions, utility sharing, rent, and more.

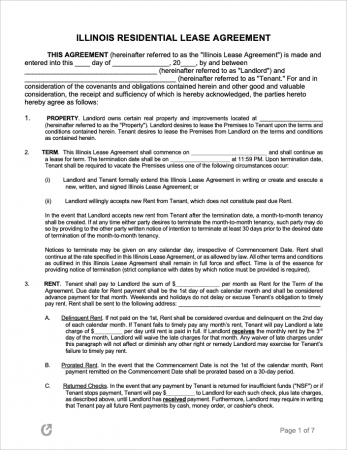

Standard Residential Lease Agreement – Used for leasing homes and apartments to tenants for a duration of one (1) year.

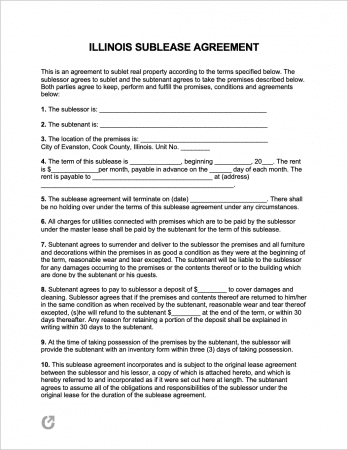

Sublease Agreement – Allows a tenant to introduce one (1) or more new tenant(s) to live in a rental property in the original tenant’s place. Permission should be received from the landlord prior to executing the form.

An Illinois Lease Agreement covers key matters pertaining to the rental of a residential or commercial property. The agreement covers the legal obligations and rights of both the lessees and lessors. Prior to accepting a tenant, a rental application should be used to ensure the tenant(s) are trustworthy and have had positive prior rental experiences.

Landlord-Tenant Guides / Handbooks

There is no state law specifying when rent is due. Rent is due on the date specified in the lease agreement. There is no grace period offered by state law.

Emergency / Non-emergency: There is no statute specifying conditions relating to landlord access to the property. It can be assumed that Illinois landlords can indeed enter at any time during an emergency. To ensure there is no confusion with tenants, this should be clearly outlined in the lease.

NOTE: Landlords of properties located in the city of Chicago are subject to the Chicago Residential Landlord Tenant Ordinance, § 5-12-050. This ordinance dictates that landlords may enter a leased property for a number of reasons including to make repairs and supply services that are necessary or have been previously agreed upon. Entry should be made at a reasonable time and notice should be given to tenants a minimum of two (2) days prior.

Per the AG Pamphlet on landlord and tenant rights, landlords are obligated to the following:

In accordance with the Attorney General Pamphlet on the rights of both landlord and tenants, the duties of tenants are as follows (not including those specified in the lease):

Maximum: No limit.

Returning to Tenant (765 ILCS 710/1(a)): Landlords must return the security deposit within forty-five (45) days of the date that the tenant vacated the property. They are required to deliver the deposit either in person or by postmarked mail. If the landlord intends to withhold a portion (or all) of the deposit, they must provide an itemized list of damages to tenants within thirty (30) days of the lease end date.

Deposit Interest (765 ILCS 715): For landlords that own twenty-five (25) units or more (can be in a single building or multiple buildings), they must pay interest to tenants on received security deposits. Interest has to be paid within thirty (30) days after the end of each twelve (12) month rental period. The rate paid for interest must be equal to the largest commercial bank. For 2020, landlords are required to pay 0.005% (.01% APY).